Venture Capitalist Camp

Under the theme of “New Investment Opportunities in the Digital Era”, the 3rd CVCC aims to help investors understand investment positioning, strategic planning and risk control, offer them a systematic methodology to conduct lifecycle management for VC projects, identify global business trends and investment opportunities in industrial transformation, and facilitate win-win cooperation between investors and entrepreneurs.

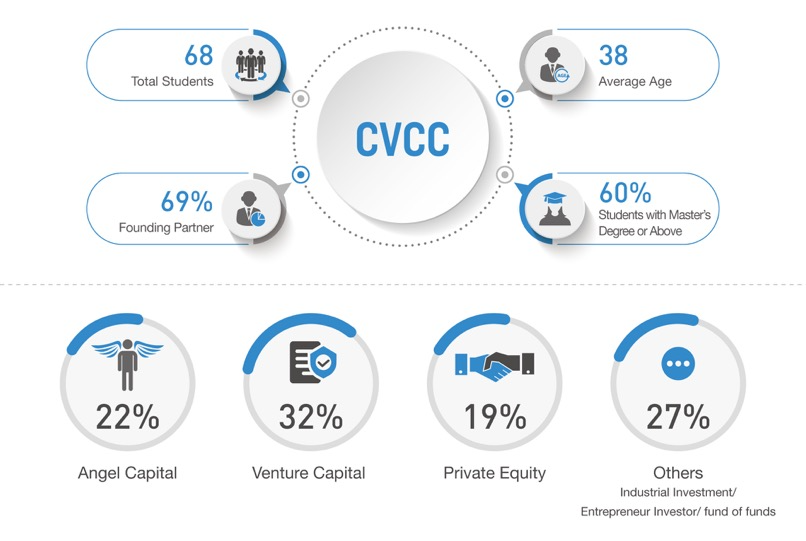

CVCC is designed for senior investors at or above partner level from VC institutions. Each applicant must be recommended by at least one VC-backed startup founder. CVCC students come from diverse backgrounds, representing the FOF, angel investors, VC, PE, strategic investors, family office, large-scale asset management firms, and financial exchanges in China and abroad. CVCC is committed to building the most valuable learning organization for China’s VC community.

COURSE OBJECTIVE

Under the theme of “New Investment Opportunities in the Digital Era”, the 3rd CVCC aims to help investors understand investment positioning, strategic planning and risk control, offer them a systematic methodology to conduct lifecycle management for VC projects, identify global business trends and investment opportunities in industrial transformation, and facilitate win-win cooperation between investors and entrepreneurs.

CVCC is designed for senior investors at or above partner level from VC institutions. Each applicant must be recommended by at least one VC-backed startup founder. CVCC students come from diverse backgrounds, representing the FOF, angel investors, VC, PE, strategic investors, family office, large-scale asset management firms, and financial exchanges in China and abroad. CVCC is committed to building the most valuable learning organization for China’s VC community.

COURSE FEATURE

- CEIBS professors are fully engaged in this programme and place an emphasis on academic rigor.

- During the overseas modules, eminent professors’ lectures focus on “local innovations + Chinese companies’ overseas investment”.

- The Real Situation Learning Method (RSLM) integrates classroom teaching with company visits and enables immersive case studies.

- The joint module for both CVCC and CELC students facilitates the in-depth communication between entrepreneurs and investors.

COURSE BENEFITS

- Develop a global perspective, and gain insights into global trends in entrepreneurship and innovation investment;

- Learn from world-class innovative companies and top-notch investors, and seize new investment opportunities;

- Attend a joint module with CELC students to exchange ideas and share experience;

- Gain membership in the CEIBS Alumni Association

TUITION FEE

RMB 238,000 (2020)

UPON THE COMPLETION OF THE COURSE, YOU WILL GAIN:

- A certificate of completion;

- Membership in the CEIBS Alumni Association. Learn more

CONTACT US

Ms. Echo Qi

Tel:86-21-28905033

Email:qecho@ceibs.edu

- Senior investors at or above partner level from VC institutions

- Directors of FOF, companies'strategic investment, family office, large-scale asset management, and financial exchanges

This one-year programme consists of seven to eight modules, which are delivered at CEIBS Shanghai Campus, Beijing Campus, Shenzhen Campus and overseas.

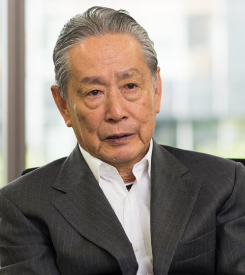

PROGRAMME CO-DIRECTOR

Associate Professor of Strategy, CEIBS

Department Chair (Economics and Decision Sciences), CEIBS

Programme Director of CEIBS Entrepreneurial Leadership Camp

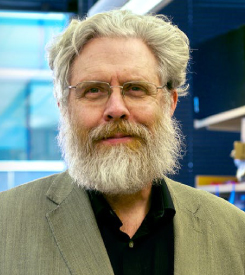

GUEST SPEAKERS

Onchain CEO